Modern Books for Modern Businesses

Modern Books is brought to you by Modern Axis CPA

We focus on the paperwork so you can stay on focused on your business.

We work with you to make your bookkeeping and compliance easy

We focus on the paperwork so you can stay on your business.

We work with you to make your tax compliance easy

Payroll

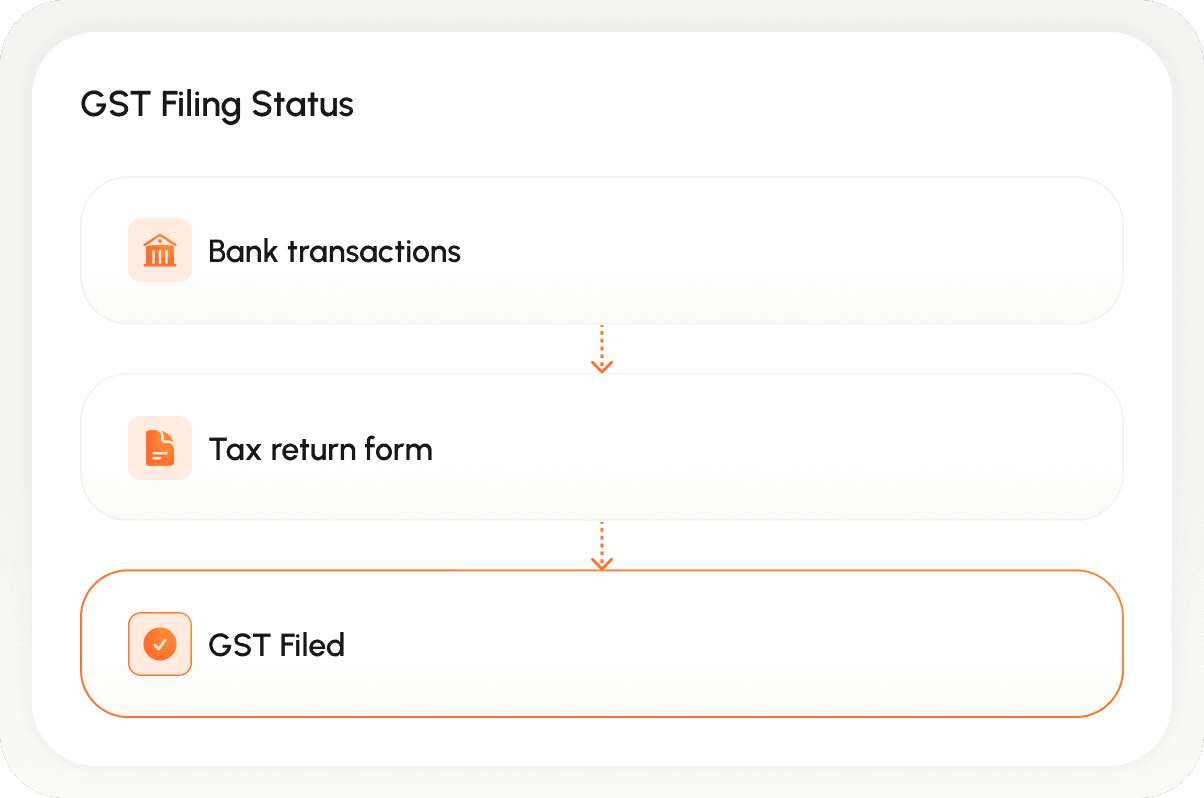

We use your live bank data to calculate your Input Tax Credits (ITCs) accurately. We prepare and file your returns on time, every time, and send you a simple notification of what’s owed. No more guessing, no more late fees.

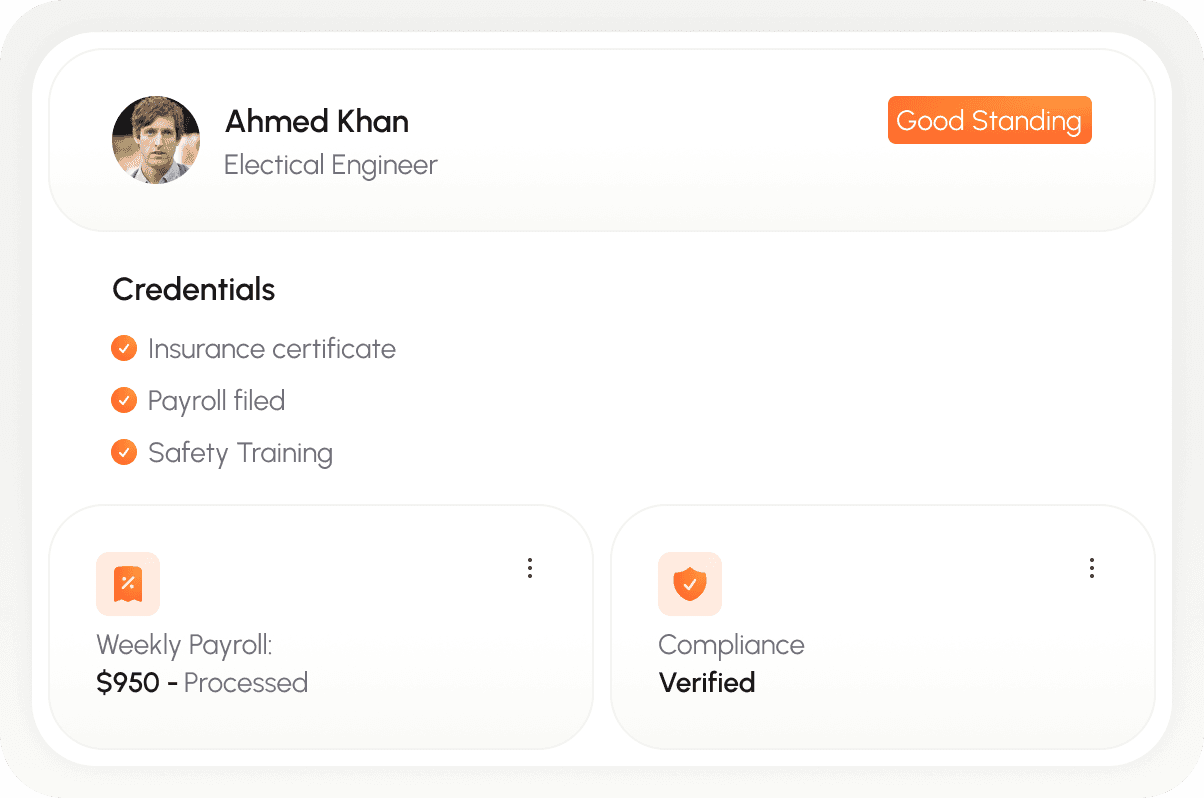

Workers' Compensation Reporting

Whether it’s WCB, WSIB, or CNESST, we handle the administrative heavy lifting of provincial insurance. We calculate your assessable payroll, manage quarterly or annual filings, and help you maintain your "Letter of Good Standing" so you can stay on the job site without interruptions.

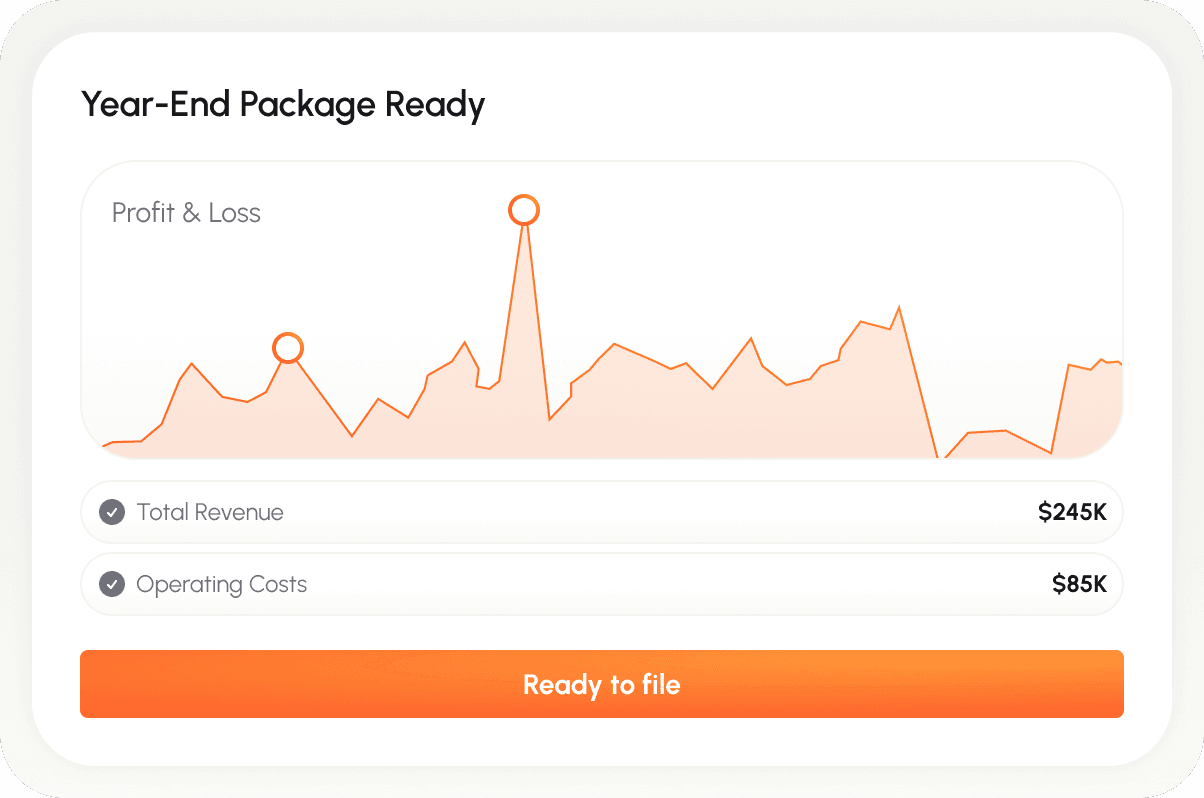

Personal & Corporate Tax Filings

We take the "tax season stress" off your plate. Whether you’re a sole proprietor filing a T2125 or a corporation requiring a T2, we handle the entire process. Because your bank feeds are synced year-round, your year-end is clean, accurate, and optimized for maximum deductions.

Simple, stress-free, and compliant.

We’ve built a streamlined workflow that keeps you on the job site while we handle the heavy lifting in the background.

Why Choose Modern Books

Built by people who understand the trades, powered by technology that respects your time.

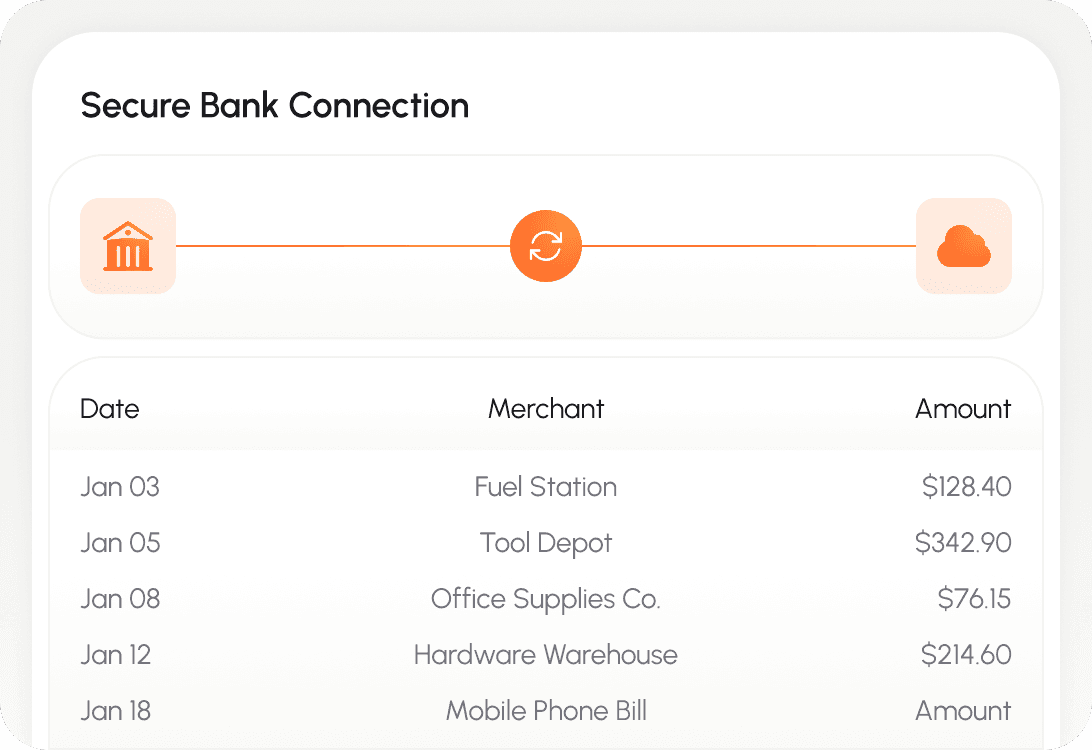

Zero Data Entry

Stop spending your Sunday nights with a calculator. Our secure bank feeds categorize your spending automatically. You don't have to touch a single receipt.

Fixed & Transparent Pricing

No hourly surprises or 'hidden' year-end fees. You pay a predictable monthly rate based on your transaction volume. You'll always know your costs upfront.

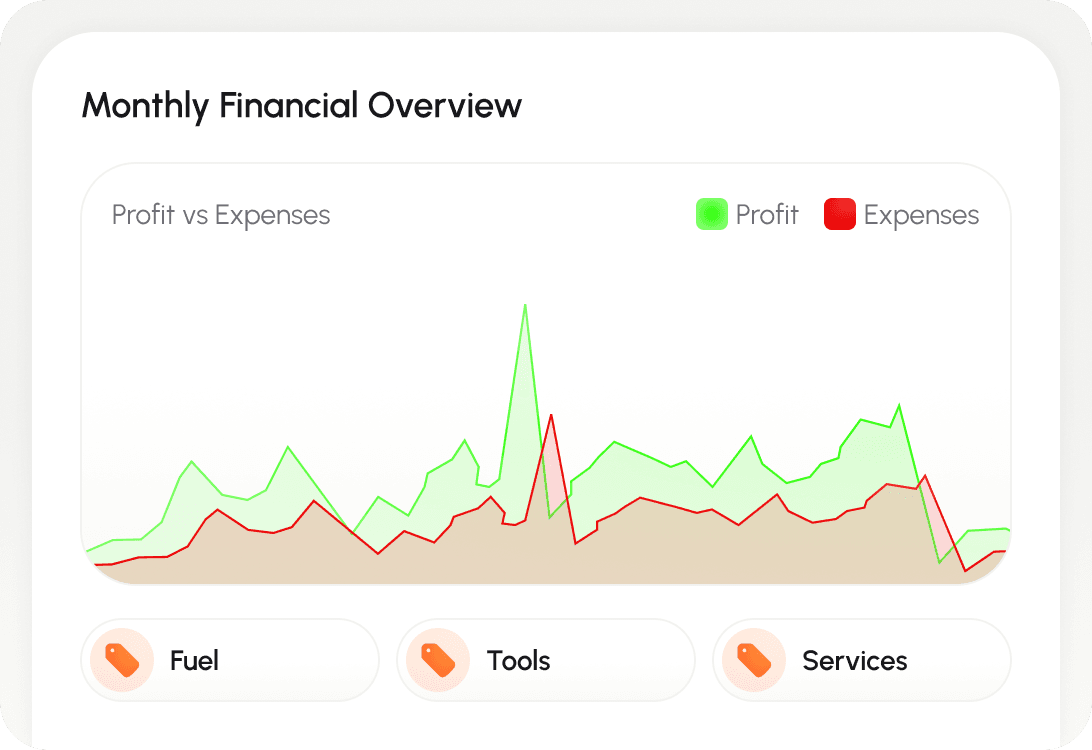

Proactive Tax Planning

We don't just look at your numbers once a year. We provide mid-year check-ins to estimate your tax bill early, so you have of time to set aside cash for the CRA.

Contractor-Specific Deductions

We know what you can actually write off from tools and safety gear to vehicle expenses and home office space. We minimize your taxes.

Penalty Protection

Late-filing fees are a waste of your hard-earned money. We track every GST and Workers' Comp deadline for you, ensuring your filings are always on time.

Year-End Optimization

Whether you are a sole prop or a corporation, we structure your filings to minimize your tax liability, taking advantage of every industry deduction available.

Pricing is based on transactions volume, averaged annually. No hourly billing.

We’ve Got the Answers You’re Looking For

Quick answers to your AI automation questions.